Get the free lease own application form

Get, Create, Make and Sign

Editing lease own application online

How to fill out lease own application form

How to fill out employee credit:

Who needs employee credit:

Video instructions and help with filling out and completing lease own application

Instructions and Help about lease own app form

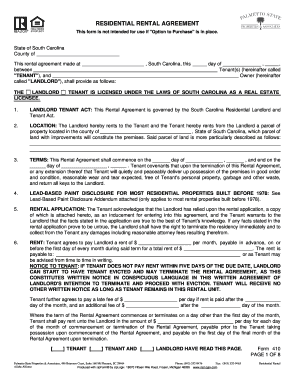

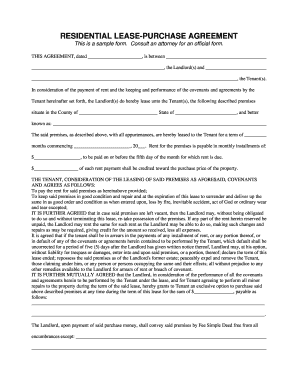

Hello and welcome the team here is dedicated to helping local families become homeowners through a unique rent-to-own program we will help you get into your dream home even if your credit isn't great, and you can't get approved for a loan right now the goal is video is to explain to you how our right to own program works, so you can determine if it's right for you and your family so here's how it works when you find a home that you want instead of putting down a security deposit you'll make a down payment of anywhere from three to seven percent of the purchase price all of your down payment goes towards the purchase of your new home when you buy the property this down payment ensures that you're the only person with the ability to buy the property and that the agreed upon purchase price will not change within the time of your lease this down payment is also called an option fee you will then move in and lease the property while you work on rebuilding your credit and getting a loan approved to purchase the home the lease is generally 18-month term but will sometimes go as long as 24 or even 36 months if you need to repair your credit we can connect you with a great company who helps many of our clients with credit repair they're unique because they also own a mortgage company, so they will know exactly how to help you get your loan approved once your loan is approved you can purchase the home you've been renting, and now you are the homeowner your days of throwing money away towards rent are gone let's take a look at a quick example with simple easy to remember numbers let's say you find a home that you love with a purchase price of $100,000 and a monthly rent of $1,000 let's say you've saved five thousand dollars to put down now this money can come from a tax refund your 401k or an IRA it can come from a cash advance on a credit card private money or gift money the list goes on you can put down four thousand dollars as a down payment which would be four percent of the purchase price you could then pay the first month's rent with the extra one thousand dollars and move into your new home remember while you're renting the home you will be working on getting a loan approved the bank will see you've already put down four thousand dollars or four percent, so the loan would be for the remainder of the purchase price which is ninety-six thousand dollars better yet if the home is worth more when you purchase let's say 115 thousand dollars that equity is yours nothing beats appreciation when the loan gets approved you purchase your new home without the hassle of having to move again and the best part is you don't pay any realtor commissions here are just a few reasons why people love our rent-to-own program first you can start living in your dream home before you have the good credit, and you won't have to move again when you purchase your home second you can purchase the property any time within the lease period and the purchase price will not change 3...

Fill homes own application : Try Risk Free

People Also Ask about lease own application

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your lease own application form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.